Who should file for bankruptcy

Home » » Who should file for bankruptcyYour Who should file for bankruptcy images are available. Who should file for bankruptcy are a topic that is being searched for and liked by netizens today. You can Download the Who should file for bankruptcy files here. Find and Download all royalty-free vectors.

If you’re looking for who should file for bankruptcy images information linked to the who should file for bankruptcy keyword, you have come to the right blog. Our website always provides you with hints for seeking the highest quality video and image content, please kindly search and locate more enlightening video articles and images that fit your interests.

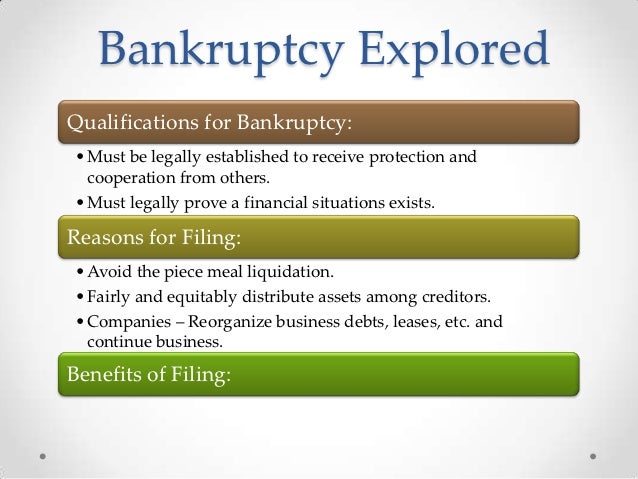

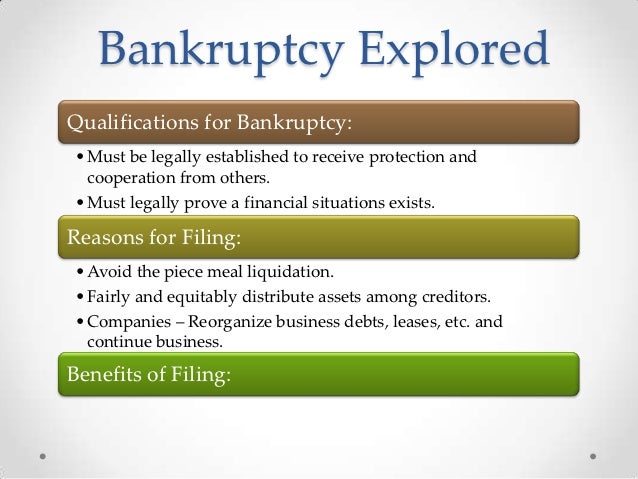

Who Should File For Bankruptcy. The mandatory meeting with creditors occurs in a public forum and it appears on your credit report, for whomever has access to that. Your income must fall below the median income for your state, and you must. If your income was too high to qualify for chapter 7, or you have significant secured debt, chapter 13 bankruptcy might be the right choice for you. Investopedia reports that the top five reasons to file bankruptcy include loss of income (from unemployment or divorce) and increase in (medical) expenses.

A Guide to Bankruptcy Facts, Misconceptions and Tips to From slideshare.net

A Guide to Bankruptcy Facts, Misconceptions and Tips to From slideshare.net

The bankruptcy abuse prevention and consumer protection act (bapcpa) now requires anyone filing to meet certain criteria: It is allowed for individuals to file for bankruptcy without a lawyer. As with the answer to the previous question, it is strongly recommended to retain a competent attorney to. See more filing considerations for married couples articles. “the bankruptcy means test examines financial records, including income, expenses, secured and unsecured debt to determine if your disposable. Usually only attorneys are permitted to file bankruptcy online.

If your business is a sole proprietorship, you must file a chapter 7 personal bankruptcy to clear your business debts.

You should also seek advice from a qualified credit counselor or financial advisor. As with the answer to the previous question, it is strongly recommended to retain a competent attorney to. The answer to “should i file bankruptcy?” will almost always be “it depends.” we hope the answer is always “no,” but here are a few signs that filing bankruptcy might be right for you. If you and your attorney decide filing for bankruptcy is right for you, the first step will be filing a petition with the clerk in whichever jurisdiction you live (there are 94 bankruptcy jurisdictions in the u.s.). Bankruptcy is an option when you lose control of your debt and interest payments are increasing the amount that you owe. “the bankruptcy means test examines financial records, including income, expenses, secured and unsecured debt to determine if your disposable.

Source: bankruptcy-law-seattle.com

Source: bankruptcy-law-seattle.com

Part of the bankruptcy process is providing large amounts of. The process itself takes three to five years to complete, on average. Part of the bankruptcy process is providing large amounts of. The mandatory meeting with creditors occurs in a public forum and it appears on your credit report, for whomever has access to that. Through chapter 13, you could pay a portion of your debt.

Source: jcklaw.com

Source: jcklaw.com

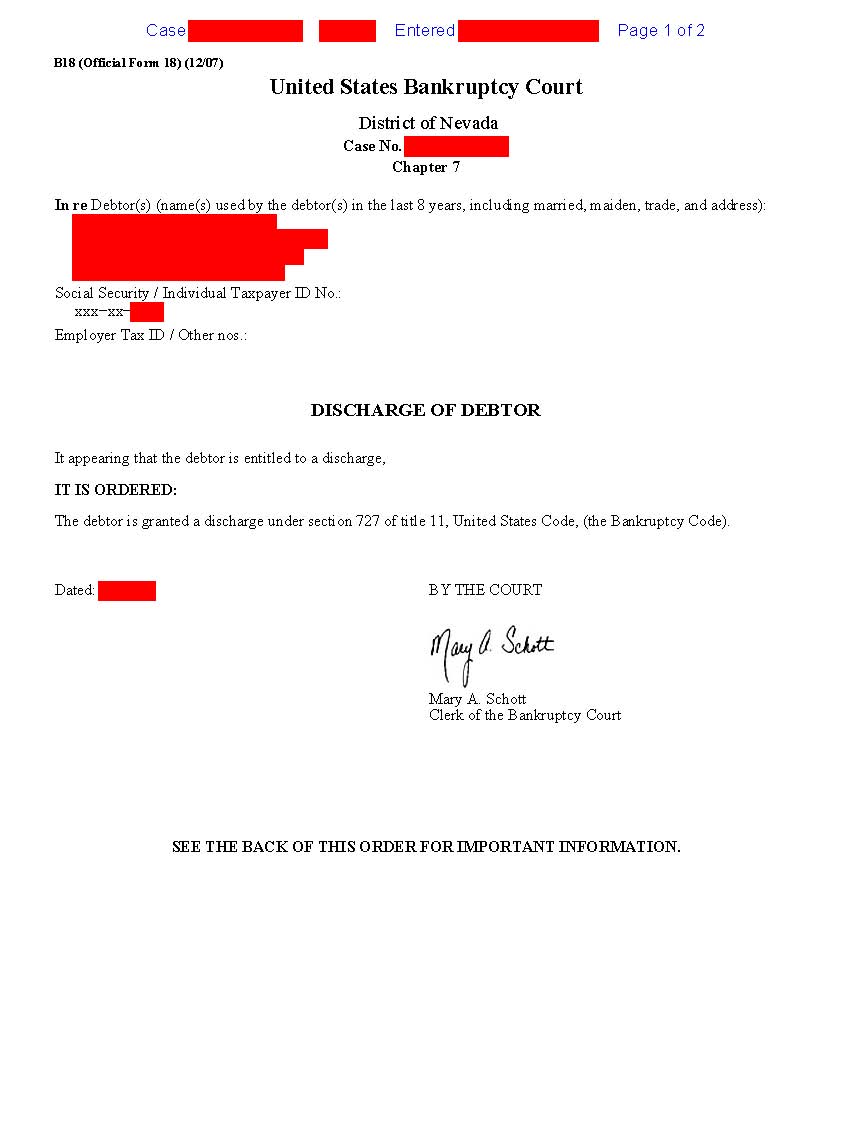

Credit counseling is also a mandatory step in the bankruptcy process. Should they be able to determine this is. Do i need a lawyer to file for bankruptcy, or can i do it on my own? In a chapter 7 bankruptcy, you do not repay any of the debt owed. It’s arguably the simplest type of bankruptcy and generally accounts for somewhere around two out of every three bankruptcy cases.

Source: slideshare.net

Source: slideshare.net

It is worth noting that it is also possible to stay in business after filing chapter 7 since there are certain exemptions to. It is worth noting that it is also possible to stay in business after filing chapter 7 since there are certain exemptions to. As with the answer to the previous question, it is strongly recommended to retain a competent attorney to. The two most common types of consumer bankruptcy are chapter 7 and chapter 13. How does filing for bankruptcy affect your credit?

Source: huffingtonpost.com

Source: huffingtonpost.com

For people who have property they want to keep, filing a chapter 13 bankruptcy may be the better choice. You should make your decision based on the type of property you have, either shared or personal. The two most common types of consumer bankruptcy are chapter 7 and chapter 13. The process itself takes three to five years to complete, on average. In most jurisdictions, consumers are not allowed to file bankruptcy online.

Source: lvbankruptcy.com

Source: lvbankruptcy.com

All remaining debt is then discharged. Bankruptcy is an option when you lose control of your debt and interest payments are increasing the amount that you owe. File for bankruptcy, do i qualify for bankruptcy, how to file bankruptcy for free, when should you file for bankruptcy, should i declare bankruptcy, declare bankruptcy, should i file bankruptcy. And may stay on your report for seven years, but it’s possible the blemish will remain for 10 years. Should i file bankruptcy ️ jan 2022.

Source: fayobserver.com

Source: fayobserver.com

When an individual or couple files a chapter 13 case, they are attempting to reorganize their financial obligations. Creditors may be calling you or filing lawsuits to get money. It is worth noting that it is also possible to stay in business after filing chapter 7 since there are certain exemptions to. This is important so the court does not suspect you have disposed of the property for the sole purpose of protecting it in a bankruptcy proceeding. Speaking with a lawyer before you�ve made up your mind may also be.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title who should file for bankruptcy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.