Who can file for bankruptcy

Home » » Who can file for bankruptcyYour Who can file for bankruptcy images are ready. Who can file for bankruptcy are a topic that is being searched for and liked by netizens now. You can Get the Who can file for bankruptcy files here. Find and Download all free vectors.

If you’re searching for who can file for bankruptcy images information related to the who can file for bankruptcy interest, you have come to the right blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Who Can File For Bankruptcy. There are several ways to file bankruptcy, each with pros and cons. A bankruptcy attorney can help you understand the best debt relief options for you. An attorney can�t change the time limits between filing dates, but they can help you decide if switching your chapter is a smart idea. Although an individual can file under chapter 11 or chapter 12 of the bankruptcy code, an overwhelming majority of individual debtors file either chapter 7 or chapter 13 bankruptcies.

DIY Chapter 13 Ways to proceed without an attorney OVLG From ovlg.com

DIY Chapter 13 Ways to proceed without an attorney OVLG From ovlg.com

The more common route is to voluntarily file for bankruptcy. About bankruptcy filing bankruptcy can help a person by discarding debt or making a plan to repay debts. Before you file for bankruptcy, you have to review your credit report and any collection notices you’ve received in the mail to make sure all of your debts are included in the bankruptcy petition. A joint bankruptcy assignment allows debtors, involved in a close financial relationship, to file for bankruptcy and to see their files dealt with as one file. When an estate is created, creditors are able to file claims with the court about what they are owed. A bankruptcy attorney can help you understand the best debt relief options for you.

Although an individual can file under chapter 11 or chapter 12 of the bankruptcy code, an overwhelming majority of individual debtors file either chapter 7 or chapter 13 bankruptcies.

Filing bankruptcy can be confusing and a lot of work. In general, filing for bankruptcy on student loans is usually part of a larger bankruptcy case involving other debts. Before you file for bankruptcy, you have to review your credit report and any collection notices you’ve received in the mail to make sure all of your debts are included in the bankruptcy petition. Can you file for bankruptcy just for student loans? If you attempt to file for bankruptcy on student loans only, there is a strong chance your case will be rejected. A bankruptcy case normally begins when the debtor files a petition with the bankruptcy court.

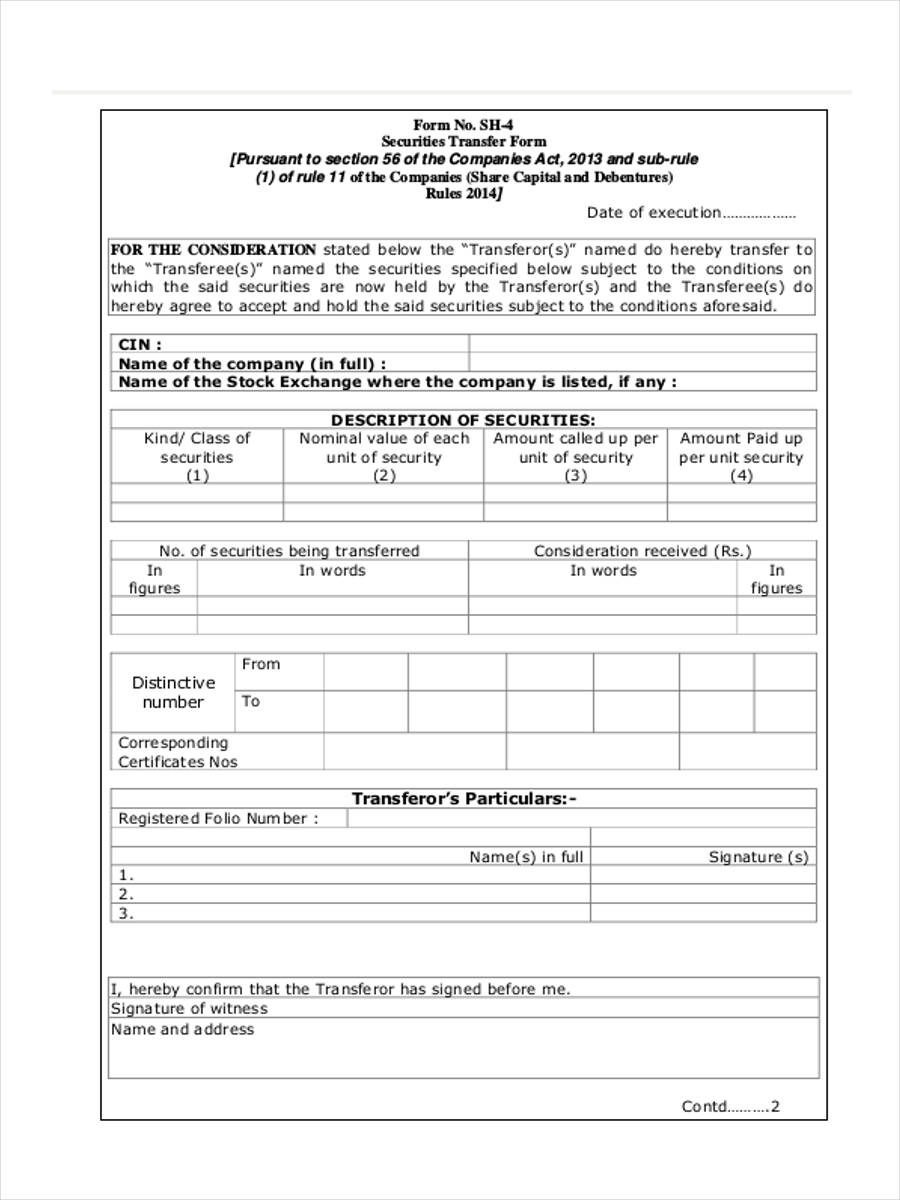

Source: sampleforms.com

Source: sampleforms.com

Filing a new chapter 13. You can also file for a chapter 13 bankruptcy just after receiving your chapter 7 bankruptcy discharge, but you will not be eligible to receive a chapter 13 discharge in your second case. When an individual files a bankruptcy, the most basic reason is to eliminate debts by receiving a discharge. In general, filing for bankruptcy on student loans is usually part of a larger bankruptcy case involving other debts. Even with the help of a bankruptcy law firm, bankruptcy can be time consuming.

Source: wcnc.com

Source: wcnc.com

Can you file for bankruptcy just for student loans? Does a married couple have to file bankruptcy together, or can just one spouse file bankruptcy? Filing for bankruptcy is complicated, and the information provided here is not exhaustive. If you attempt to file for bankruptcy on student loans only, there is a strong chance your case will be rejected. Yes, you can file a chapter 13 bankruptcy without your spouse but the latter’s income will be taken into account during the proceedings.

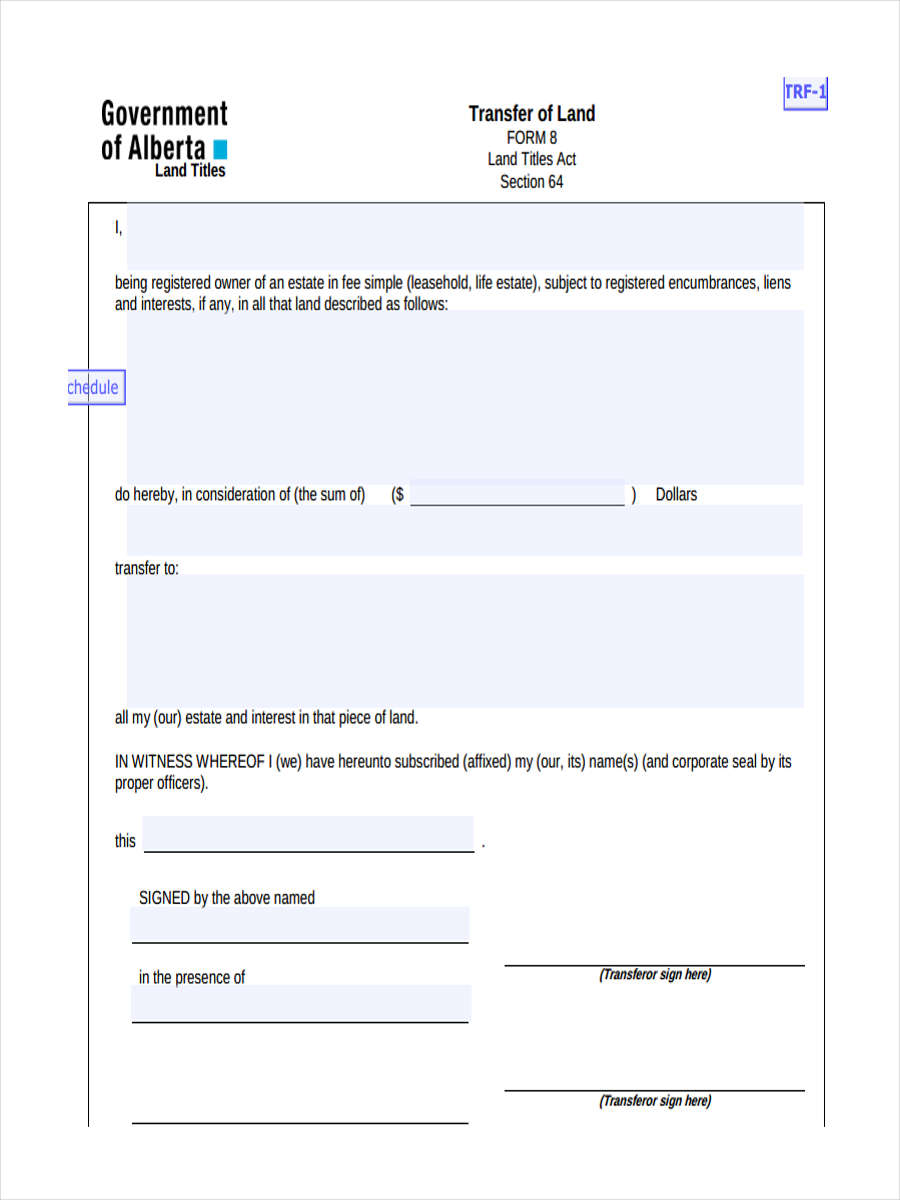

Source: sampleforms.com

Source: sampleforms.com

Before you file for bankruptcy, you have to review your credit report and any collection notices you’ve received in the mail to make sure all of your debts are included in the bankruptcy petition. Hiring a good bankruptcy attorney is one way to file. Taking the time to be sure you qualify can streamline the process. Before you file for bankruptcy, you have to review your credit report and any collection notices you’ve received in the mail to make sure all of your debts are included in the bankruptcy petition. The quick answer is yes, but the issue is more complex than most may think.

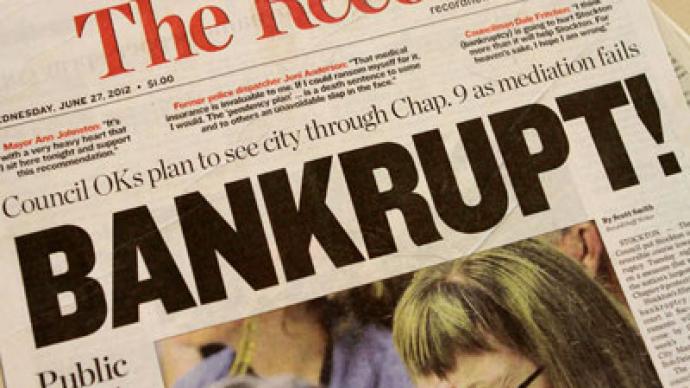

Source: rt.com

Source: rt.com

In a chapter 7, the individual eliminates unsecured. But yes, you can file bankruptcy online if you hire a lawyer who has registered with the court. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. The second way is for creditors to ask the court to order a person bankrupt. Debtors who have enough disposable income each month to pay at least a portion of their unsecured debts may not discharge these debts through chapter 7 bankruptcy.

Source: newfoxy.com

Source: newfoxy.com

Filing for bankruptcy takes some preparation. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. They can also help you prepare to file as soon as the date is available to you. Various circumstances determine whether filing bankruptcy individually is even a possible option for. A petition may be filed by an individual, by spouses together, or by a corporation or other entity.

Source: 1040return.com

Source: 1040return.com

Filing for chapter 7 bankruptcy There are several ways to file bankruptcy, each with pros and cons. Debtors who have enough disposable income each month to pay at least a portion of their unsecured debts may not discharge these debts through chapter 7 bankruptcy. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. Section 109 states that only an “individual” can file a chapter 13 bankruptcy case.

Source: ovlg.com

Source: ovlg.com

An attorney can�t change the time limits between filing dates, but they can help you decide if switching your chapter is a smart idea. In a chapter 7, the individual eliminates unsecured. A bankruptcy case normally begins when the debtor files a petition with the bankruptcy court. Can you file for bankruptcy just for student loans? Various circumstances determine whether filing bankruptcy individually is even a possible option for.

Source: turingfinance.com

Source: turingfinance.com

Bankruptcy can provide a great sense of relief, but you must meet all of the requirements before you can file. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter. When an estate is created, creditors are able to file claims with the court about what they are owed. Although an individual can file under chapter 11 or chapter 12 of the bankruptcy code, an overwhelming majority of individual debtors file either chapter 7 or chapter 13 bankruptcies. So, can one person file for bankruptcy without their spouse?

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title who can file for bankruptcy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.