When should you file bankruptcy

Home » » When should you file bankruptcyYour When should you file bankruptcy images are ready. When should you file bankruptcy are a topic that is being searched for and liked by netizens today. You can Get the When should you file bankruptcy files here. Find and Download all royalty-free photos.

If you’re looking for when should you file bankruptcy images information related to the when should you file bankruptcy topic, you have come to the right blog. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

When Should You File Bankruptcy. While you should talk to a professional before making any big decisions, outlined here is a short timeline for filing for bankruptcy. How to file for bankruptcy. The process will depend, location to location, but this can give you a vague idea of some of the critical points you will have to go through. When should you file chapter 13 bankruptcy.

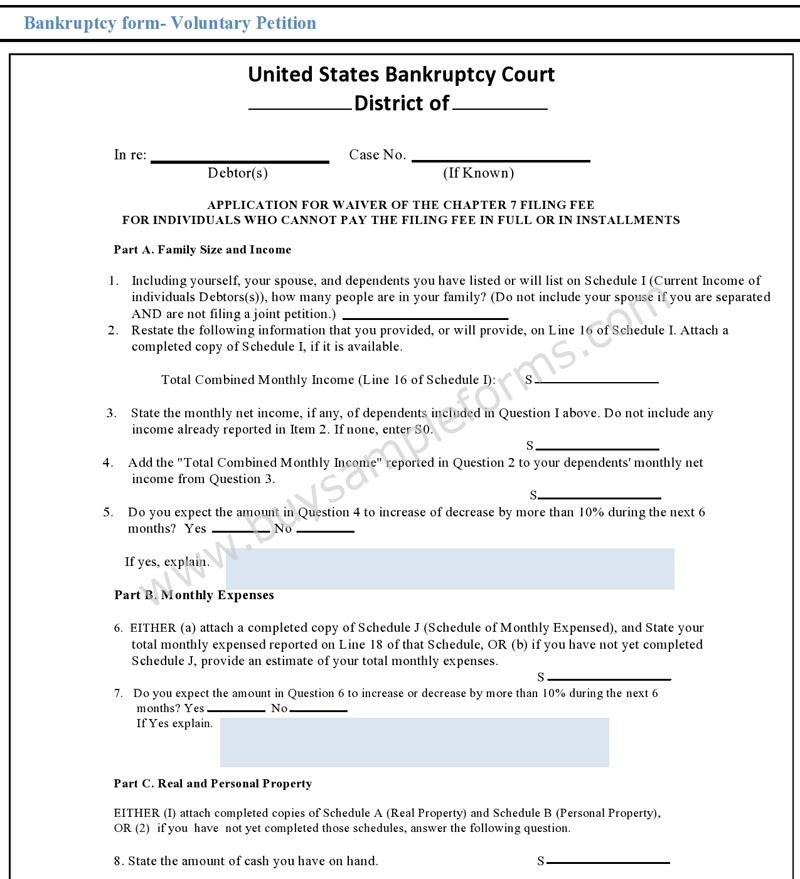

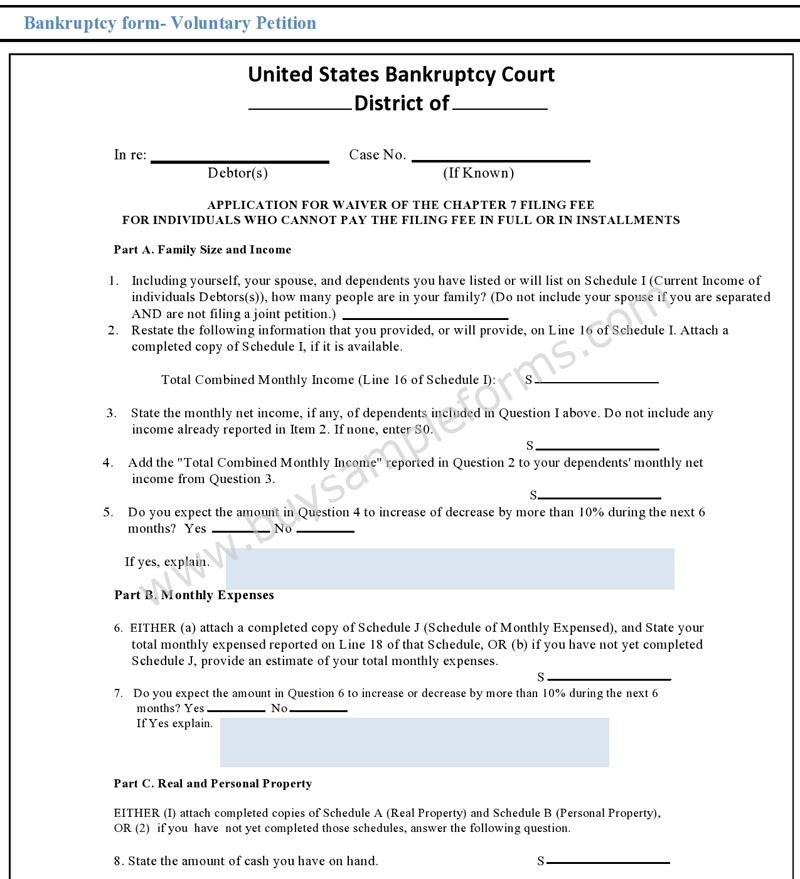

Fillable Bankruptcy Form Sample Fillable Bankruptcy Form From buysampleforms.com

Fillable Bankruptcy Form Sample Fillable Bankruptcy Form From buysampleforms.com

In order to find your disposable income (for bankruptcy filing purposes), you take your monthly household income and subtract the allowable expense for every category (based on the size of your household). Filing for bankruptcy in 2022. What’s left over is your disposable income. The moment you file for bankruptcy, this will trigger an automatic stay that will stop wage garnishment, lawsuits, foreclosure, and collection efforts. Now take your monthly disposable income and multiply it by 60. But, for some people, declaring bankruptcy is the only way to get out of serious debt.

When you file bankruptcy, you’re immediately protected by the federal bankruptcy court.

Yes, thats 8 long years. When you are first considering filing for bankruptcy, it can be difficult to make sense of the bankruptcy process and the available options. This does not mean that you will not get a credit card, buy a home, or car for 10 years. It’s a major step, and one that shouldn’t be taken lightly. What to avoid when filing bankruptcy. The following are some of the best reasons to file:

Source: buysampleforms.com

Source: buysampleforms.com

To determine where you are financially, inventory all of your liquid assets. When you file a chapter 7 bankruptcy, you cannot file again until after 8 years. You can file bankruptcy without counsel, but i don’t recommend it because the laws. Your bankruptcy filing is likely to suffer if you have not filed your income tax returns for the last two years. Should i file bankruptcy ️ jan 2022.

Source: debt.org

Source: debt.org

The real expense is hiring an attorney, which could range from $2,000 to $4,000, depending on the firm and the type of bankruptcy you choose. The process will depend, location to location, but this can give you a vague idea of some of the critical points you will have to go through. The real expense is hiring an attorney, which could range from $2,000 to $4,000, depending on the firm and the type of bankruptcy you choose. Yes, thats 8 long years. When should you file chapter 13 bankruptcy.

Source: divorcebankruptcylaw.com

Source: divorcebankruptcylaw.com

Do not fail to file your taxes income tax returns are significant when filing for bankruptcy because they help determine your current and past earnings and asset holdings. This does not mean that you will not get a credit card, buy a home, or car for 10 years. Additional reasons to file bankruptcy. You’ll also include some bankruptcy basics, like what type of bankruptcy you’re filing under and whether a bankruptcy lawyer is helping you. The most common example of this is if you are trying to protect your home from a foreclosure.

Source: bankruptcy-canada.com

Source: bankruptcy-canada.com

Our bankruptcy guide can help you understand the bankruptcy process and learn to navigate the bankruptcy process successfully in 2021. Now, we call it an automatic stay but think of it as an injunction. Debts that are more than the value of your assets or debts that have become unmanageable are one of the reasons why you may need to file for bankruptcy. While you should talk to a professional before making any big decisions, outlined here is a short timeline for filing for bankruptcy. So if the amount of your debt is not that high, you might want to save that chapter 7 filing for future use just in.

Source: divorcebankruptcylaw.com

Source: divorcebankruptcylaw.com

5 signs you should consider declaring bankruptcy. It’s an injunction against creditor contract with you directly and it goes into effect immediately. • your creditors are suing you. Why should you file for bankruptcy? In order to find your disposable income (for bankruptcy filing purposes), you take your monthly household income and subtract the allowable expense for every category (based on the size of your household).

Source: focusedlaw.com

Source: focusedlaw.com

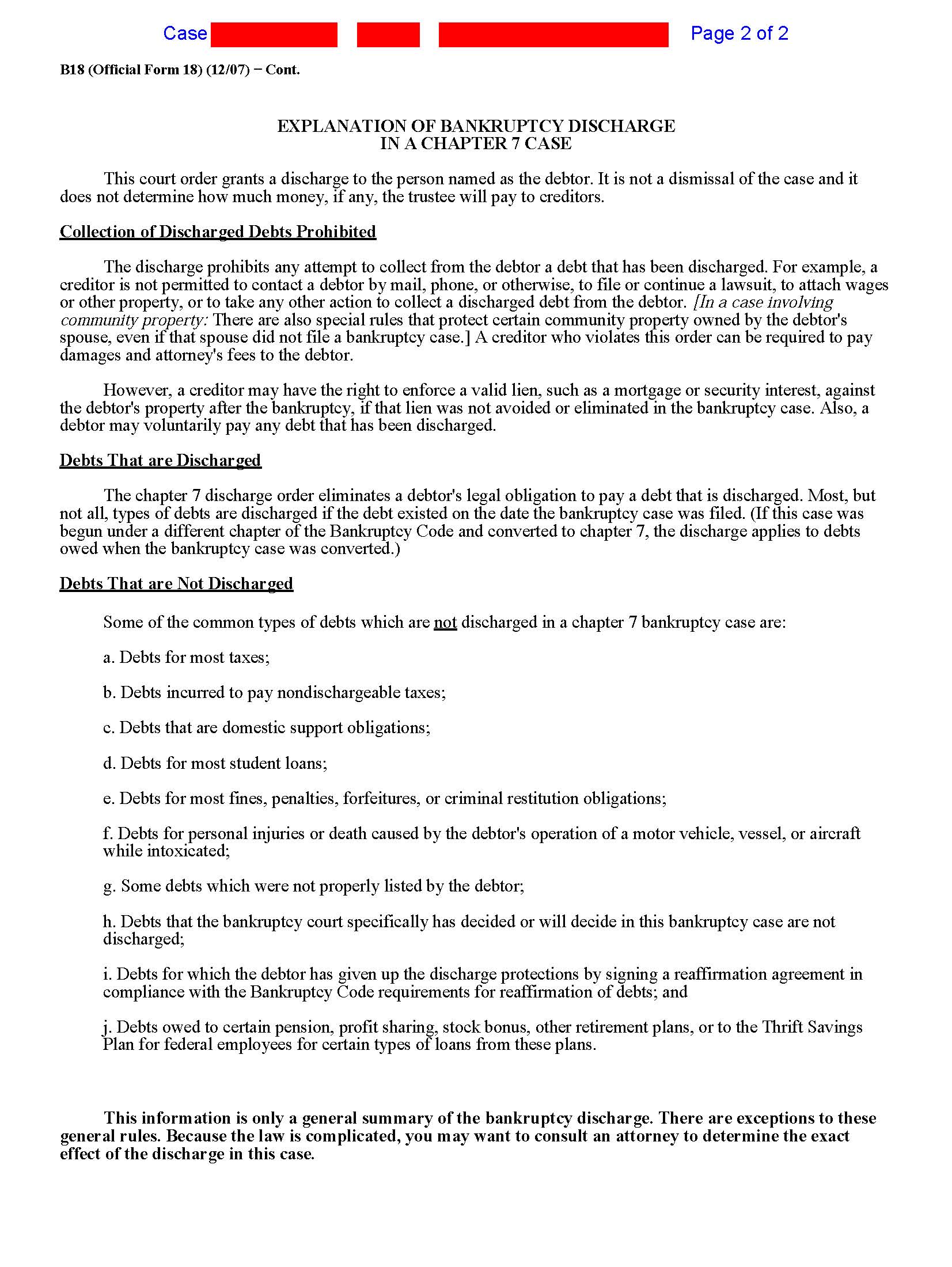

It is a good idea to hold off on filing if you believe there is a chance to improve your financial situation or that you will have substantial expenses in the near future because there is a limit to how often you can file for bankruptcy. Debts that are more than the value of your assets or debts that have become unmanageable are one of the reasons why you may need to file for bankruptcy. So if the amount of your debt is not that high, you might want to save that chapter 7 filing for future use just in. A bankruptcy entry will appear on your credit report for up to 10 years after you file. Bankruptcy is a legal procedure where a judge declares an individual’s debts as discharged, which makes it impossible for creditors to force payment.

Source: marlincash.com

Source: marlincash.com

Your bankruptcy filing is likely to suffer if you have not filed your income tax returns for the last two years. When you file bankruptcy, you’re immediately protected by the federal bankruptcy court. Owe at least $1,000 in unsecured debt, are unable to pay your debts as they come due or, you owe more in debts than the value of the assets you own, and, you must either reside, do business, or have property in canada. The other option is chapter 13 bankruptcy, which is known as the “wage earner’s bankruptcy” because it requires that you have a steady source of income and unsecured debts (credit cards, medical bills, personal loans, etc.) of less than $394,725 and secured debts (home, car, property, etc.) of less than $1,184,200. Bankruptcy is a legal procedure where a judge declares an individual’s debts as discharged, which makes it impossible for creditors to force payment.

Source: lvbankruptcy.com

Source: lvbankruptcy.com

On the other hand, a bankruptcy filing may need to be accelerated if you are trying to protect your interest in property that may be taken away by a creditor. When you file a chapter 7 bankruptcy, you cannot file again until after 8 years. The other option is chapter 13 bankruptcy, which is known as the “wage earner’s bankruptcy” because it requires that you have a steady source of income and unsecured debts (credit cards, medical bills, personal loans, etc.) of less than $394,725 and secured debts (home, car, property, etc.) of less than $1,184,200. Yes, thats 8 long years. While you should talk to a professional before making any big decisions, outlined here is a short timeline for filing for bankruptcy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when should you file bankruptcy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.