Unsecured start up business loans

Home » » Unsecured start up business loansYour Unsecured start up business loans images are available. Unsecured start up business loans are a topic that is being searched for and liked by netizens today. You can Download the Unsecured start up business loans files here. Download all royalty-free images.

If you’re looking for unsecured start up business loans images information connected with to the unsecured start up business loans keyword, you have come to the right site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

Unsecured Start Up Business Loans. Our financial search specialists are available to support you through the rest of the unsecured start up loan process. An unsecured startup loan is a key to your success and the start of a new beginning. In the agreement, the borrowers request to borrow money, as they. After you apply, we’re committed to finding the right financing solution for your business.

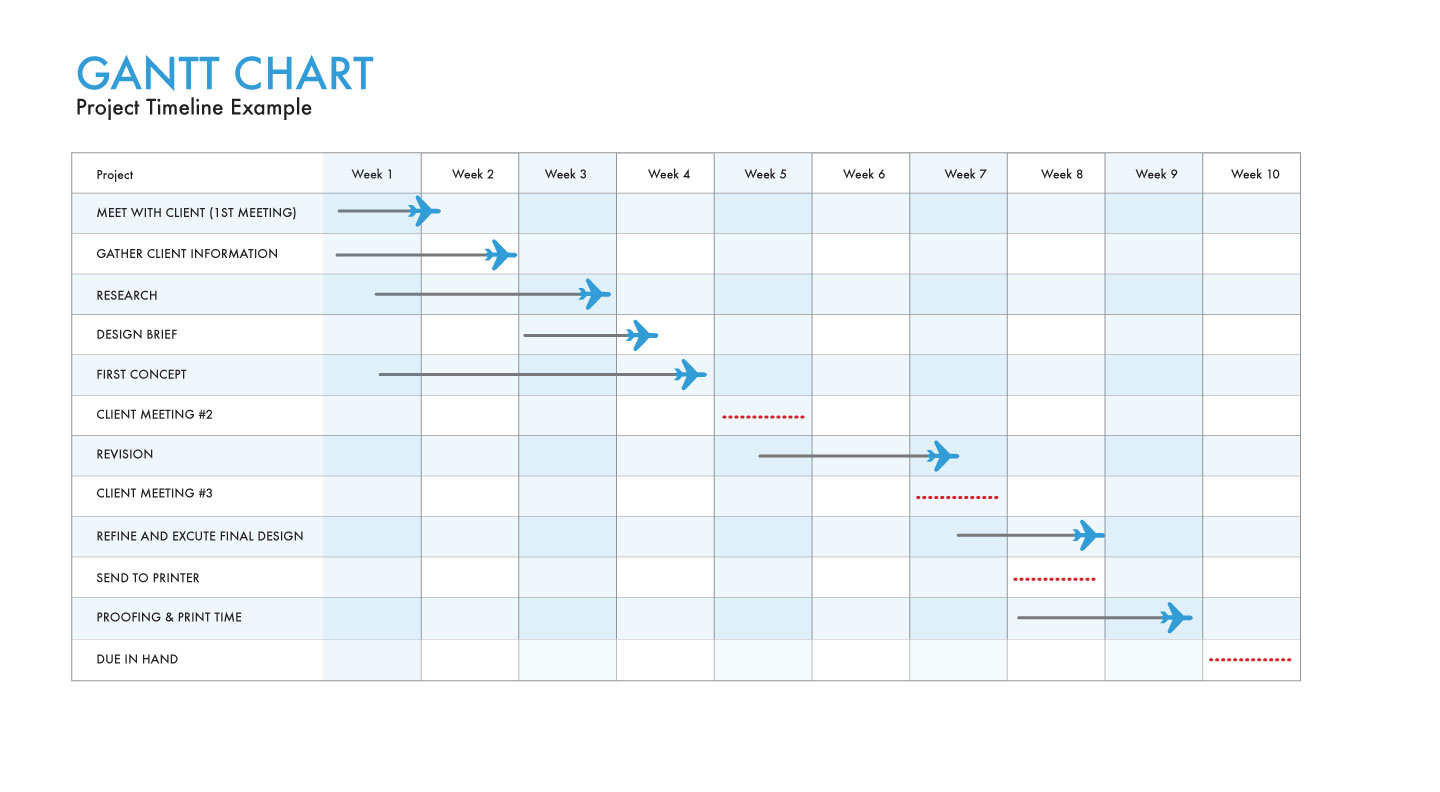

Ascend Startup Business Plan for DES MGT Gantt Chart From ascendbusinessplan.blogspot.com

Ascend Startup Business Plan for DES MGT Gantt Chart From ascendbusinessplan.blogspot.com

After you apply, we’re committed to finding the right financing solution for your business. Unsecured business loans usually have faster approval times than secured loans. An unsecured startup loan is a key to your success and the start of a new beginning. Fill out the startup loan form today and put america one unsecured to work for you. Can i get an unsecured business loan for my startup business? If you are starting a small business and an unsecured loan seems like the best option for you, feel free to apply for ones that are best suited for your purposes.

The unsecured start up business loan was created to give our clients the financial resources to start their own businesses without the hassle of an sba loan.

We offer an opportunity to apply for our unsecured business loans on top of over a loan taken from the other lenders. An unsecured startup loan is a key to your success and the start of a new beginning. The unsecured start up business loan was created to give our clients the financial resources to start their own businesses without the hassle of an sba loan. Banks want to know that the money they are lending out will be repaid regardless of the. You can get your business up and running quicker, and it can help you make an impact in your desired field of business. If you are starting a small business and an unsecured loan seems like the best option for you, feel free to apply for ones that are best suited for your purposes.

Source: pymnts.com

Source: pymnts.com

At least two years in business, a personal credit score in the high 600s, and $100,000 in revenue. Startup business lenders does not require any income documentation; Unsecured business loans, also known as uncollateralized loans, allow an owner to borrow capital without any collateral requirements. We offer an opportunity to apply for our unsecured business loans on top of over a loan taken from the other lenders. Unsecured small business loans can be very useful for first time small business owners who do not have a satisfactory guarantee that they can put forth when seeking financing.

Source: lendgenius.com

Source: lendgenius.com

The unsecured start up business loan was created to give our clients the financial resources to start their own businesses without the hassle of an sba loan. Our financial search specialists are available to support you through the rest of the unsecured start up loan process. Yes, you can get unsecured business loans for startups. Unsecured small business loans can be very useful for first time small business owners who do not have a satisfactory guarantee that they can put forth when seeking financing. At least two years in business, a personal credit score in the high 600s, and $100,000 in revenue.

Source: newhorizon.org

Source: newhorizon.org

Unsecured business loans usually have faster approval times than secured loans. Unsecured business loans, also known as uncollateralized loans, allow an owner to borrow capital without any collateral requirements. Can i get an unsecured business loan for my startup business? Our online unsecured business loans application is simple to use and will only take a few minutes to complete. An unsecured business loan is a type of loan specifically designed for the needs of business owners, rather than individuals, and what makes them ‘unsecured’ is that they do not require you to put up company assets (for example property, stock or equipment) as security against the loan.

Source: ventilatsiooni-puhastus.ee

Source: ventilatsiooni-puhastus.ee

Get business financing, startup funding, credit building, unsecured credit lines, sba 504 7a loans, micro loans, cash flow advance, business credit cards and. Startup business lenders does not require any income documentation; You can avail an unsecured business loan ranging from rs 50,000 to rs 25 lakhs. An unsecured business loan is a type of loan specifically designed for the needs of business owners, rather than individuals, and what makes them ‘unsecured’ is that they do not require you to put up company assets (for example property, stock or equipment) as security against the loan. We are quite flexible in our approach.

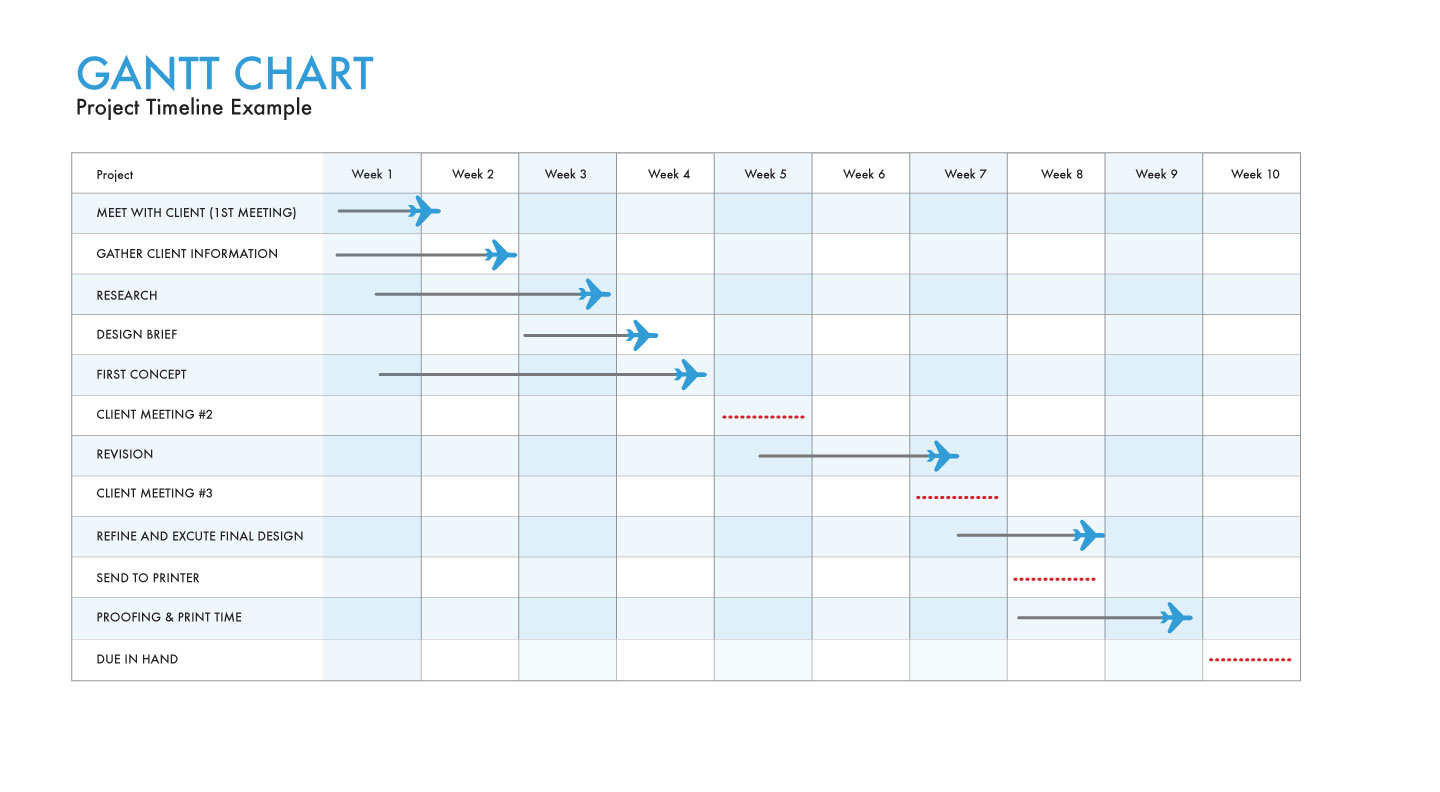

Source: ascendbusinessplan.blogspot.com

Source: ascendbusinessplan.blogspot.com

With the online application and quick disbursal system, our minimal loan processing time becomes a key highlight for many smes that are struggling to get a loan within a specified time. At least two years in business, a personal credit score in the high 600s, and $100,000 in revenue. We offer flexible payment options and can customize a loan program to match your financial and payment needs. Startup business lenders does not require any income documentation; With the online application and quick disbursal system, our minimal loan processing time becomes a key highlight for many smes that are struggling to get a loan within a specified time.

Source: infinitycommerciallending.com

Source: infinitycommerciallending.com

The start up phase of any business is one of the hardest times to acquire the necessary working capital and other resources needed to make your business thrive. You can avail an unsecured business loan ranging from rs 50,000 to rs 25 lakhs. Unsecured small business loans can be very useful for first time small business owners who do not have a satisfactory guarantee that they can put forth when seeking financing. To qualify, you only have to persuade the lender of your willingness and ability to repay the loan, but may be subject to hire interest rates or other conditions instead. Startup business lenders does not require any income documentation;

Source: amone.com

Source: amone.com

We are quite flexible in our approach. To qualify, you only have to persuade the lender of your willingness and ability to repay the loan, but may be subject to hire interest rates or other conditions instead. As a traditional lender, bank of america advertises a much lower apr than online lenders—but only if you meet strict application requirements: At least two years in business, a personal credit score in the high 600s, and $100,000 in revenue. Can i get an unsecured business loan for my startup business?

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title unsecured start up business loans by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.