How much debt for bankruptcy

Home » » How much debt for bankruptcyYour How much debt for bankruptcy images are ready. How much debt for bankruptcy are a topic that is being searched for and liked by netizens now. You can Download the How much debt for bankruptcy files here. Download all free photos.

If you’re looking for how much debt for bankruptcy pictures information related to the how much debt for bankruptcy topic, you have visit the ideal site. Our website always provides you with suggestions for seeking the highest quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

How Much Debt For Bankruptcy. What type of debt can you include in bankruptcy? Ok, now i am concerned. Today, they account for about 3. But if $10,000 is from student loans and the other $2,000 from credit cards, bankruptcy may not be the right choice.

EuroZone Profiteers How German and French Banks Helped From commondreams.org

EuroZone Profiteers How German and French Banks Helped From commondreams.org

There is no minimum debt amount required to qualify for filing bankruptcy. Many people may not be aware of this but the laws don’t specify any minimum amount. You must keep paying rent and any new debts after the bankruptcy. This means that whether you have $10,000 or $100,000, you can file for this type of bankruptcy. This article seeks to address concerns surrounding “how much debt do you need to file bankruptcy?”. In other words, there is no minimum debt threshold that you must reach before you are allowed to file.

Today, they account for about 3.

It�s because bankruptcy comes with serious consequences. This article seeks to address concerns surrounding “how much debt do you need to file bankruptcy?”. You must keep paying rent and any new debts after the bankruptcy. According to the american bankruptcy institute (abi), 63% of the 774,940 bankruptcy cases filed in 2019. There is no threshold amount that you need to reach to file a bankruptcy. Currently, for unsecured debts, the limit is $394,725, and for secured debts, the limit is $1,184,200.

Source: dailydetroit.com

Source: dailydetroit.com

There is no minimum debt to file for bankruptcy. For instance, you can�t cram down a car debt if you purchased the car during the 30 months before filing for bankruptcy. That being said, you certainly can and should evaluate if filing a bankruptcy makes sense in your current situation. There is no minimum debt to file for bankruptcy. However, you may not have more than $1,257,850 in secured debts or $419,275 in unsecured debt.

Source: thebalance.com

Source: thebalance.com

The bankruptcy code gives debtors a few options for fixing their financial straits. On the other hand, there’s a maximum debt. Many people may not be aware of this but the laws don’t specify any minimum amount. It�s because bankruptcy comes with serious consequences. You might not need to pay bills that are unpaid at the date of your bankruptcy order.

Source: commondreams.org

Source: commondreams.org

Hmmm, at 365 days a year, that would be 365 billion dollars a year. How much debt you should have in chapter 7 bankruptcy. In 1980, businesses accounted for 13 percent of bankruptcies. There is no minimum debt to file for bankruptcy. The vast majority of bankruptcies are now filed by consumers and not by businesses.

Source: lendingtree.com

Source: lendingtree.com

Today, they account for about 3. There is no minimum debt amount required to qualify for filing bankruptcy. Ok, now i am concerned. Before you make any major decisions, here are some things to. When thinking about whether you owe enough for bankruptcy to be a sensible option remember to distinguish between secured and unsecured debts.

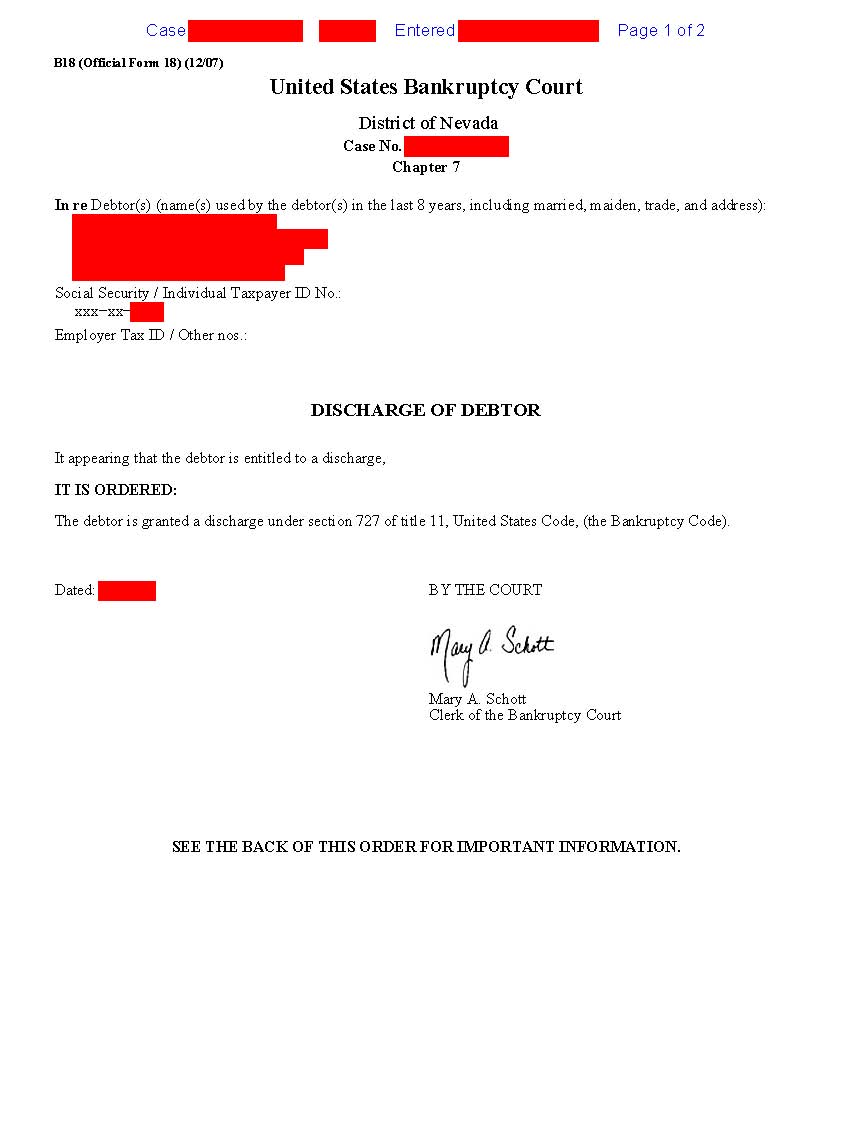

Source: lvbankruptcy.com

Source: lvbankruptcy.com

The bankruptcy code gives debtors a few options for fixing their financial straits. When thinking about whether you owe enough for bankruptcy to be a sensible option remember to distinguish between secured and unsecured debts. You cannot have more than $394,725 of unsecured debt and $1,184,200 of secured debt (for 2018) if you want to file for this type of bankruptcy. On the other hand, there is a maximum debt limit that you need to know especially if you are filing a chapter 13 bankruptcy. In 1980, businesses accounted for 13 percent of bankruptcies.

Source: sport.one

Source: sport.one

Several factors go into determining how much debt you can have to file a chapter 7 bankruptcy. This article seeks to address concerns surrounding “how much debt do you need to file bankruptcy?”. But if $10,000 is from student loans and the other $2,000 from credit cards, bankruptcy may not be the right choice. You cannot have more than $394,725 of unsecured debt and $1,184,200 of secured debt (for 2018) if you want to file for this type of bankruptcy. That being said, you certainly can and should evaluate if filing a bankruptcy makes sense in your current situation.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how much debt for bankruptcy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.