File for bankruptcy chapter 7

Home » » File for bankruptcy chapter 7Your File for bankruptcy chapter 7 images are available. File for bankruptcy chapter 7 are a topic that is being searched for and liked by netizens now. You can Get the File for bankruptcy chapter 7 files here. Get all free photos and vectors.

If you’re searching for file for bankruptcy chapter 7 images information connected with to the file for bankruptcy chapter 7 topic, you have come to the right blog. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly search and find more informative video content and images that fit your interests.

File For Bankruptcy Chapter 7. Here are a few reasons why chapter 7 makes sense: Your creditors can no longer sue you in court or garnish your salary when you file for bankruptcy. Filing bankruptcy chapter 7 ️ jan 2022. Chapter 7 bankruptcy is one of the two types of individual bankruptcy that you can file for to relieve and eventually discharge unsecured debts.

How to Remove Alltran Financial from Your Credit Report From crediful.com

How to Remove Alltran Financial from Your Credit Report From crediful.com

Filing bankruptcy chapter 7 ️ jan 2022. Much of the paperwork you’ll need to file for chapter 7 bankruptcy can be obtained directly from the u.s. Here are a few reasons why chapter 7 makes sense: Filing the petition will trigger an “ automatic stay ,’’ which means creditors can’t pursue lawsuits, garnish your wages or contact you about your debts. Once you hire your attorney, most of. All of your nonexempt assets will be sold in order to pay off as much debt as possible.

Filing for bankruptcy takes some preparation.

Chapter 7, as with other bankruptcy chapters, is not available to individuals who have had bankruptcy cases dismissed within the prior 180 days under specified circumstances. In chapter 7, a bankruptcy trustee is appointed to sell certain debtor assets to compensate creditors, in full or in part, thereby allowing the debtor a “fresh start” after the bankruptcy discharge. If you fall under any of the categories that make you ineligible for chapter 7 bankruptcy, another option for consideration is chapter 13. Your creditors can no longer sue you in court or garnish your salary when you file for bankruptcy. With several different types of bankruptcy to choose from, it’s important to do your research on the pros, cons, and situational factors associated with each. Individuals who reside, have a place of business, or own property in the united states may file for bankruptcy in a federal court under chapter 7 (straight bankruptcy, or liquidation).

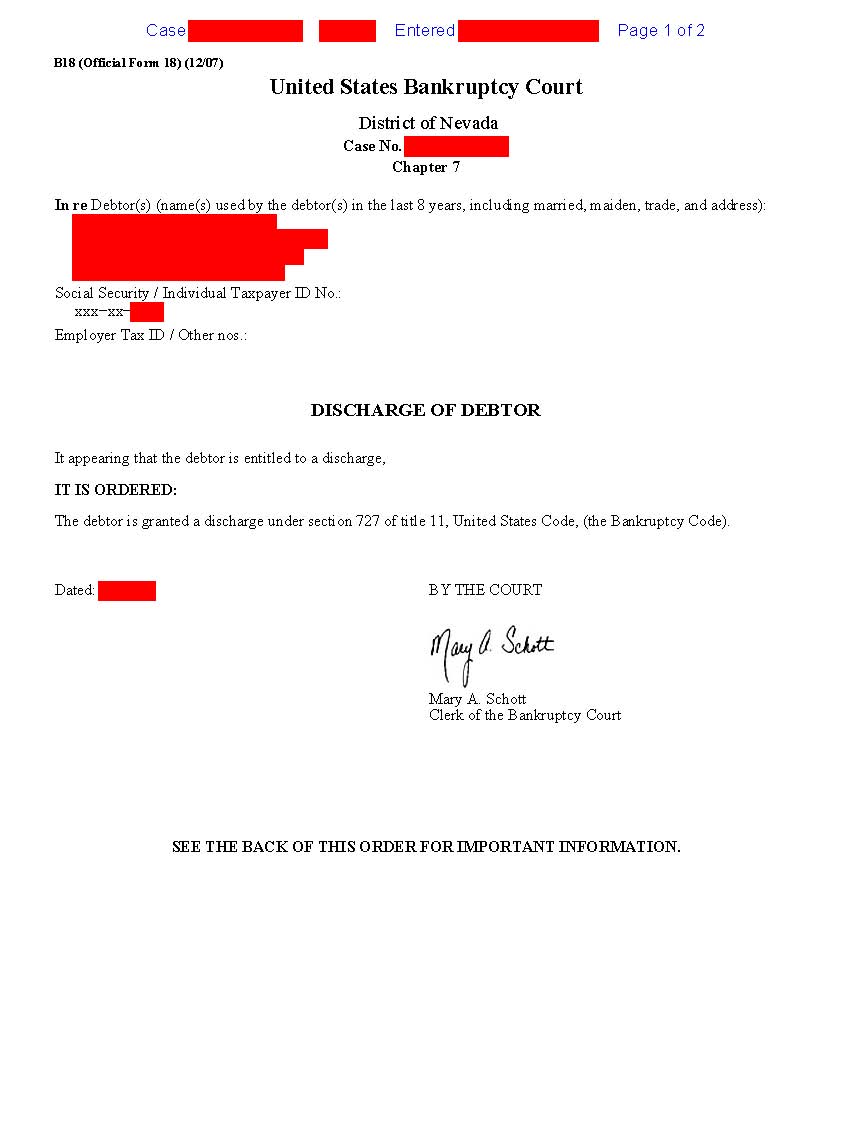

Source: atlantablackstar.com

Source: atlantablackstar.com

After a chapter 7 bankruptcy discharge, you are legally free of any dismissed obligations. The most important factor in filing chapter 7 bankruptcy is finding an experienced bankruptcy attorney. Chapter 7 bankruptcy explained, bankruptcy requirements, how to file bankruptcy for free, how to file for bankruptcy yourself, what is chapter 7 bankruptcy mean, how to file for. Filing for chapter 7 is different than filing for chapter 13 for a few different reasons. Your local bankruptcy court may also require local paperwork, which you can obtain from the court or from your bankruptcy attorney.

Source: thebalance.com

Source: thebalance.com

In certain situations, those with a higher income may still be allowed file for chapter 7 depending on circumstances, while others may be able to file for a chapter 13 instead Filing for chapter 7 is different than filing for chapter 13 for a few different reasons. In general, chapter 7 is the fastest and least expensive of the bankruptcy filing options, although it will remain on your credit report for years. After a chapter 7 bankruptcy discharge, you are legally free of any dismissed obligations. Chapter 7 bankruptcy is one of the two types of individual bankruptcy that you can file for to relieve and eventually discharge unsecured debts.

Source: dallasnews.com

Source: dallasnews.com

All of your nonexempt assets will be sold in order to pay off as much debt as possible. Hiring a good bankruptcy attorney is one way to file. You can file bankruptcy under chapter 7 once every 8 years. Once you complete your counseling, you can begin your. In certain situations, those with a higher income may still be allowed file for chapter 7 depending on circumstances, while others may be able to file for a chapter 13 instead

Source: lvbankruptcy.com

Source: lvbankruptcy.com

Unsecured debts are debts where a lender does not have any collateral being held to protect themselves in the event that a loan is not repaid. The next step is to file your petition and other paperwork for bankruptcy. How to file bankruptcy chapter 7 ️ jan 2022. Chapter 7 bankruptcy is one of the two types of individual bankruptcy that you can file for to relieve and eventually discharge unsecured debts. First of all, chapter 7 bankruptcy is essentially known as liquidation.

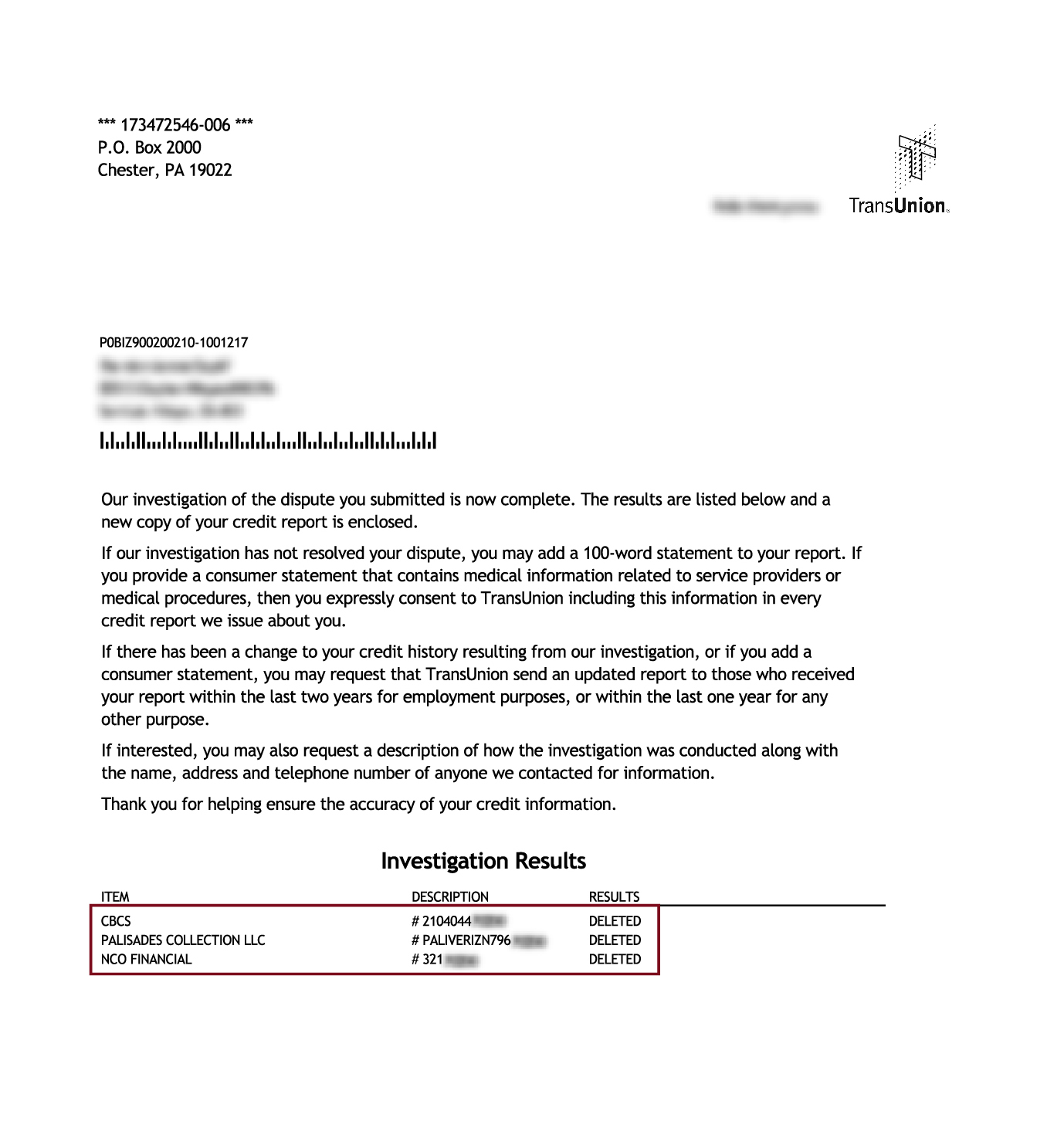

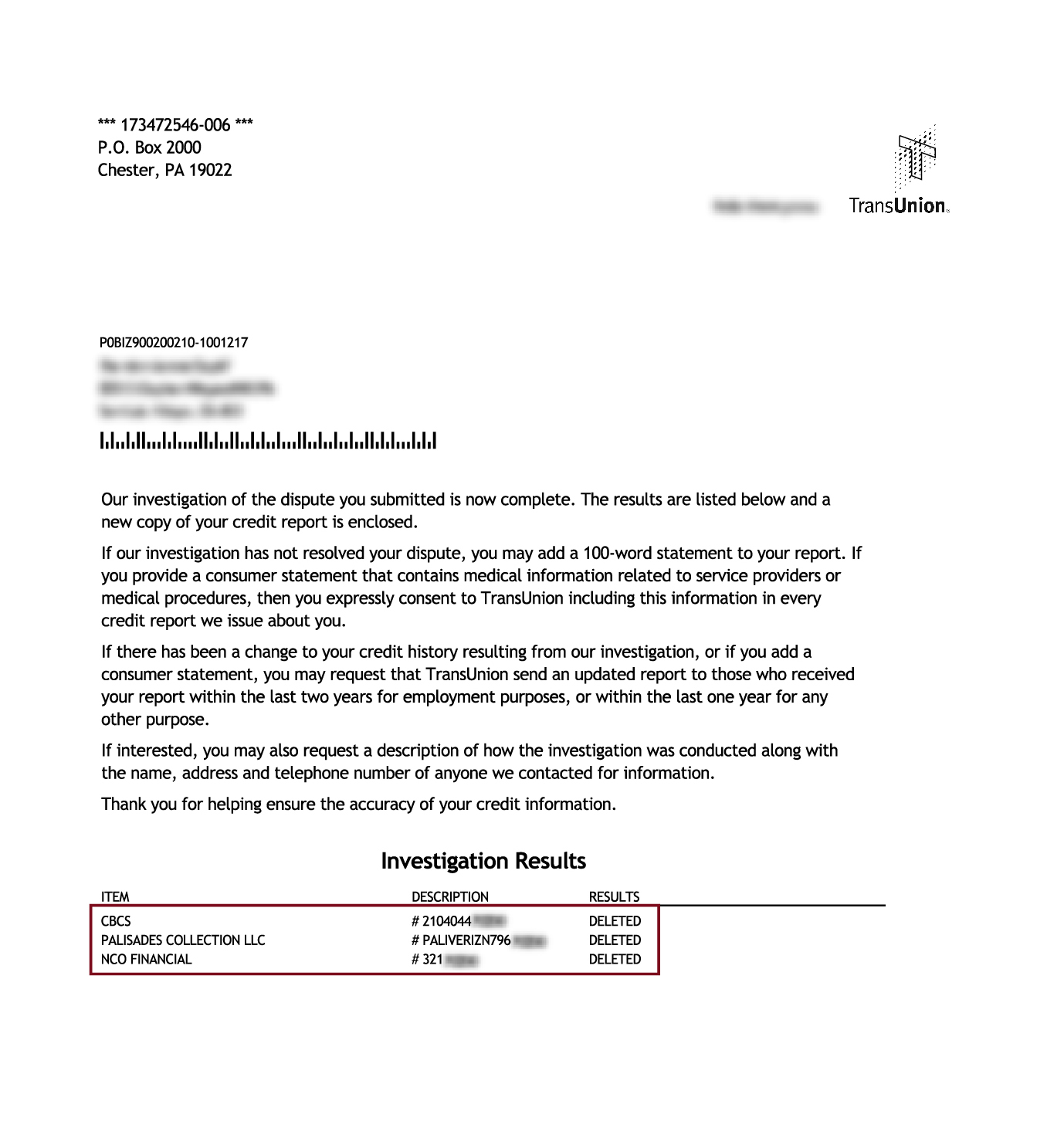

Source: crediful.com

Source: crediful.com

Filing bankruptcy chapter 7 ️ jan 2022. Although chapter 7 is a liquidation bankruptcy, filers are able to keep all their property in more than 90% of all consumer bankruptcy cases in the united states. Unsecured debts are debts where a lender does not have any collateral being held to protect themselves in the event that a loan is not repaid. A typical chapter 7 bankruptcy case is less complex than a chapter 11, chapter 12 or chapter 13. With several different types of bankruptcy to choose from, it’s important to do your research on the pros, cons, and situational factors associated with each.

Source: huskerlaw.com

Source: huskerlaw.com

Most persons who declare chapter 7 bankruptcy have their debts dismissed and are not obligated to reimburse creditors. How to file bankruptcy chapter 7 ️ jan 2022. As a result, filing bankruptcy will initially lower your credit score. The next step is to file your petition and other paperwork for bankruptcy. Filing the petition will trigger an “ automatic stay ,’’ which means creditors can’t pursue lawsuits, garnish your wages or contact you about your debts.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title file for bankruptcy chapter 7 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.