File for bankruptcy chapter 13

Home » » File for bankruptcy chapter 13Your File for bankruptcy chapter 13 images are available in this site. File for bankruptcy chapter 13 are a topic that is being searched for and liked by netizens today. You can Get the File for bankruptcy chapter 13 files here. Find and Download all free images.

If you’re searching for file for bankruptcy chapter 13 pictures information connected with to the file for bankruptcy chapter 13 topic, you have visit the right blog. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

File For Bankruptcy Chapter 13. What about chapter 13 bankruptcy? Chapter 13 bankruptcy offers a solution for people who have regular income, but are overburdened with debt. It is an alternative to the chapter 7 bankruptcy and is granted if you are earning a regular income and would like to pay your debts but require a certain amount of time. Chapter 13 bankruptcy can help debtors avoid foreclosures, repossessions, service shut off or loss of property

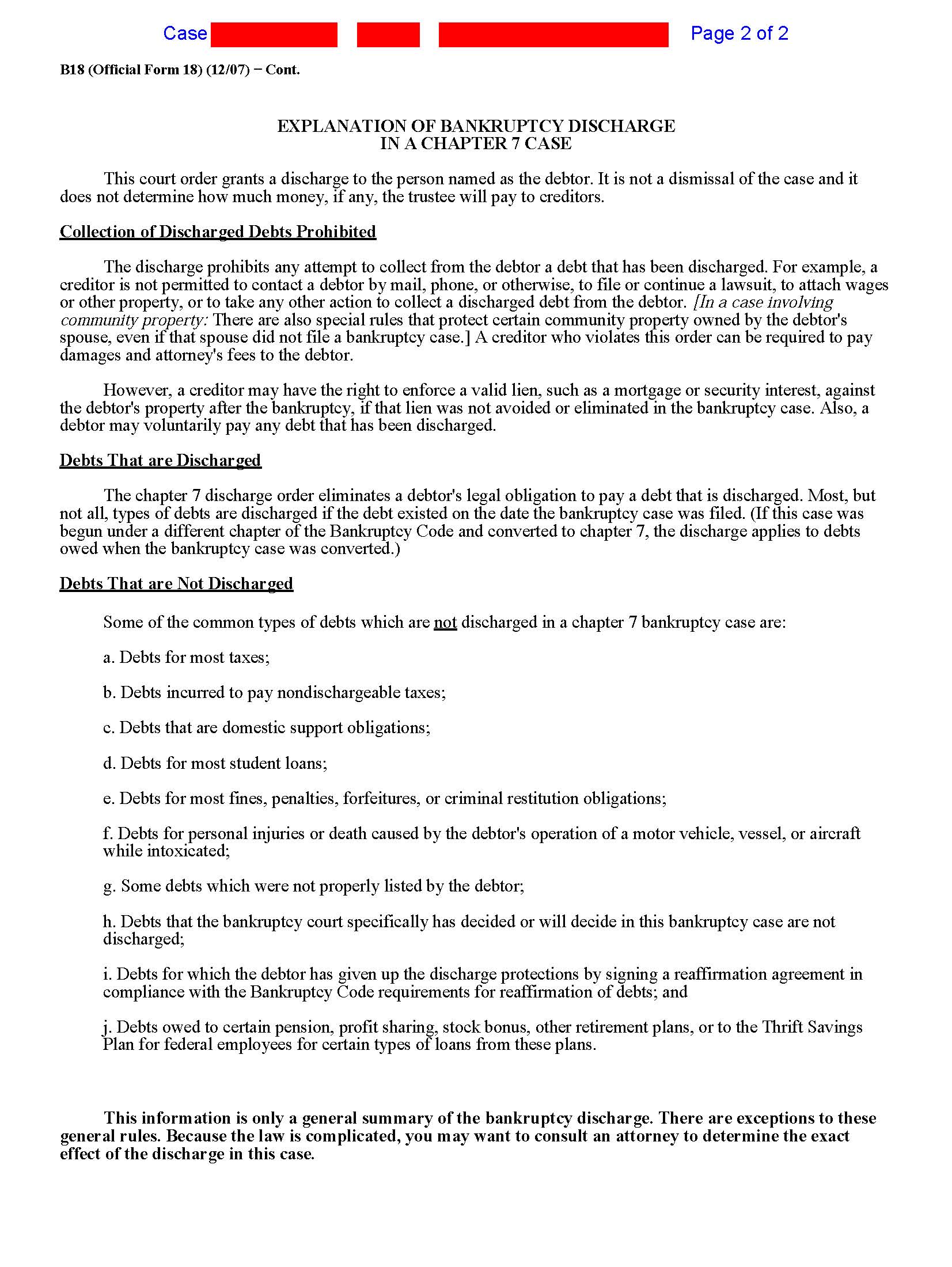

Discharging Debts Overview From thebalance.com

Discharging Debts Overview From thebalance.com

At the end of that period, some remaining unsecured debt may be discharged. You cannot have filed a bankruptcy petition (chapter 7 or 13) in the previous 180 days that was dismissed for certain reasons, such as failing to appear in court or comply with court orders. There are disadvantages to chapter 13 bankruptcy as well. Make sure to also print out the exact number of copies your local bankruptcy court requires. It also stops a wage garnishment right away. (3) a schedule of executory contracts and unexpired leases;

(2) a schedule of current income and expenditures;

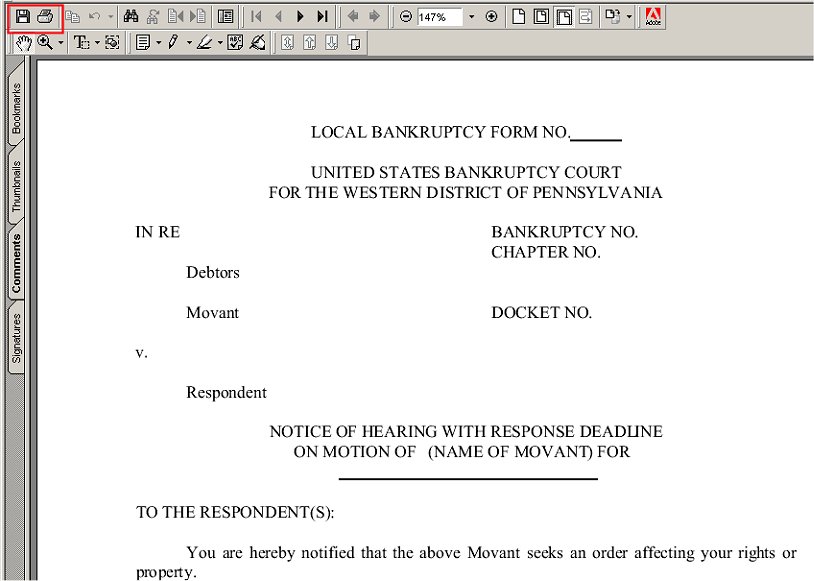

Chapter 13 bankruptcy opens an opportunity for individuals to reorganize and restructure their financial circumstances with adjusted repayment terms. You�ll start the bankruptcy process by filing the bankruptcy petition and a proposed chapter 13 repayment plan with the bankruptcy court. Filing bankruptcy chapter 13 ️ jan 2022. Unless the court orders otherwise, the debtor must also file with the court: Before doing anything else, decide if filing bankruptcy. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter.

Source: pawb.uscourts.gov

Source: pawb.uscourts.gov

(2) a schedule of current income and expenditures; There is no fee waiver option when filing a chapter 13 case like there is with a chapter 7. Once you file for chapter 7 or chapter 13 bankruptcy, your creditors are by law, not allowed to contact you for any debt collection purposes. That’s the law that prohibits creditors from contacting you as soon as your bankruptcy case has been filed. You’ll need to pay the full amount directly to the court when you go to file your forms.

Source: debt.org

Source: debt.org

(1) schedules of assets and liabilities; Unless the court orders otherwise, the debtor must also file with the court: Once you file for chapter 7 or chapter 13 bankruptcy, your creditors are by law, not allowed to contact you for any debt collection purposes. Filing bankruptcy chapter 13 ️ jan 2022. A debtor must meet chapter 13 requirements to file for bankruptcy under this chapter.

Source: lvbankruptcy.com

Source: lvbankruptcy.com

Once you file for chapter 7 or chapter 13 bankruptcy, your creditors are by law, not allowed to contact you for any debt collection purposes. Before doing anything else, decide if filing bankruptcy. Benefits of filing for chapter 13 bankruptcy. Or paying off a priority debt, like the irs. (2) a schedule of current income and expenditures;

Source: johnturcolaw.com

Source: johnturcolaw.com

Catching up a house payment; Benefits of filing for chapter 13 bankruptcy. There are disadvantages to chapter 13 bankruptcy as well. Make sure to also print out the exact number of copies your local bankruptcy court requires. Filing a chapter 13 bankruptcy means you need to use your income to repay all or some of what you owe to creditors over three to five years, depending on how much you owe.

Source: thebalance.com

Source: thebalance.com

You cannot have filed a bankruptcy petition (chapter 7 or 13) in the previous 180 days that was dismissed for certain reasons, such as failing to appear in court or comply with court orders. You�ll start the bankruptcy process by filing the bankruptcy petition and a proposed chapter 13 repayment plan with the bankruptcy court. Appealing the dismissal of a chapter 13 bankruptcy. Next, file a petition with the bankruptcy court in your home district. (2) a schedule of current income and expenditures;

Source: dailymail.co.uk

Source: dailymail.co.uk

Catching up a house payment; Next, file a petition with the bankruptcy court in your home district. It also stops a wage garnishment right away. Once you file for chapter 7 or chapter 13 bankruptcy, your creditors are by law, not allowed to contact you for any debt collection purposes. An individual who is badly in debt can typically file for bankruptcy either under chapter 7 (liquidation, or straight bankruptcy) or chapter 13 (reorganization).in some cases, options may also include chapter 12 (family farmer reorganization) and chapter 11 (reorganization of a company, or an individual debtor whose debts exceed the limits for a.

Source: propublica.org

Source: propublica.org

If you need to file a second bankruptcy, chapter 13 is only a two year waiting period versus eight years for chapter 7. That’s the law that prohibits creditors from contacting you as soon as your bankruptcy case has been filed. What about chapter 13 bankruptcy? Unless the court orders otherwise, the debtor must also file with the court: Once you file for chapter 7 or chapter 13 bankruptcy, your creditors are by law, not allowed to contact you for any debt collection purposes.

Source: bankruptcyinbrief.com

Source: bankruptcyinbrief.com

This is a strategy employed for a client who is eligible to file a chapter 7 but is also in need of: Actually, you can file a chapter 13 bankruptcy immediately after filing a chapter 7 bankruptcy. An individual who is badly in debt can typically file for bankruptcy either under chapter 7 (liquidation, or straight bankruptcy) or chapter 13 (reorganization).in some cases, options may also include chapter 12 (family farmer reorganization) and chapter 11 (reorganization of a company, or an individual debtor whose debts exceed the limits for a. You�ll start the bankruptcy process by filing the bankruptcy petition and a proposed chapter 13 repayment plan with the bankruptcy court. If you file for chapter 13 bankruptcy, your case will most likely last between three and five years, depending on the length of your repayment plan.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title file for bankruptcy chapter 13 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.